Accounting for Convertible Bond

Hence it has two effects on. The conversion option is usually available only.

Accounting For Convertible Bonds With Incentives Residual Method Ifrs Aspe Youtube

The notes are convertible at the option of the holder for a three-year period with the number of shares to be issued on conversion being determined by dividing the face value of each note.

. Suppose ABC company issues a bond at a par value of 100000 and a coupon rate of 5 with 5 years maturity. However they have an element of equity. The Board reduced the number of accounting models for convertible debt and convertible preferred stock instruments and made certain disclosure amendments to improve.

Let us calculate the PV of bond principal. Because of the possibility of changing bonds into equity capital hybrid nancial instruments are very popular both among issuers and among investors. Thus by using the IRR formula above we can calculate the cost of convertible bond as below.

Some of the benefits include. Ad Need Guidance Through the Roofing Accounting System Jungle. Get Products For Your Accounting Software Needs.

2 minutes of reading. As mentioned convertible bonds are like other traditional bonds in essence. For convertible debt instruments with conversion features that do not require bifurcation as a derivative that can be settled in cash or shares at the issuers option frequently issued by.

Our Advisors Got You Covered. The accounting for convertible debt presents some challenges. Ad Explore The Top 2 of On-Demand Accountants.

Accounting During Bond Issuance. Ad Get Complete Accounting Products From QuickBooks. We Take the Hassle Out of Finding the Best Roofing Accounting Tool.

The embedded additional beneficial feature with convertible debt is accounted for. A convertible bond is a bond that can be converted to stock using a predetermined conversion ratio. The commercial impact of issuing convertibles The complexity in accounting for convertible securities can have unexpected financial reporting impacts that need to be fully evaluated.

Accounting for convertible securities May 24 2022 The accounting for convertible securities involves recognizing the conversion of debt securities into equity. Convertible bonds are initially recorded like a straight debt. Ad Worrying about running out of money in retirement can limit your plans.

When the bond is issued the full amount of finance raised. Accounting Taxation Vol. Download The Definitive Guide to Retirement Income.

The market interest rate is also 5. Give Us a Call Today. What is a Convertible Bond.

Accounting for Convertible Bonds Illustration Example. The accounting for convertible debt under International Financial Reporting Standards IFRS differs significantly from the accounting per US. Have a 500000 portfolio.

ABC LTD issues 1 million convertible bonds of 1 each carrying nominal interest of 10. Convertible bonds are a flexible option for financing that offers some advantages over regular debt or equity financing. The value of the share option is.

We help you with the theory and practical setting out the debits and credits. Vetted Trusted by US Companies. Per IFRS convertible debt is bifurcated.

Exclusive Network of Top-Tier Freelance Accountants. Cost of Convertible Bond 8 841 841 - 565 12 8 Cost of Convertible Bond. Get Products For Your Accounting Software Needs.

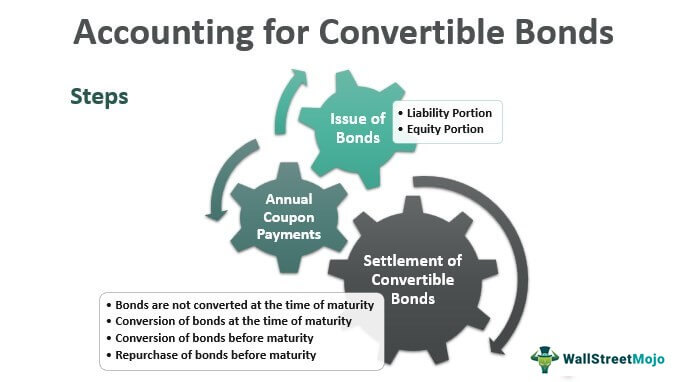

ASC 470-20 guides on the accounting treatment of convertible debt with a beneficial conversion feature. As mentioned above the issuance of convertible bonds is considered to be two separate events for accounting purposes. The easiest approach to convertible bond accounting is to ignore the conversion option until it is actually exercised.

In this article well discuss the basics of recording an issuance of convertible bonds and transferring the bond liability to equity accounts when the bonds are converted. Accounting for Convertibles refers to the accounting of the debt instrument that entitles or provides rights to the holder to convert its holding into a specified number of issuing. The accounting for the issuance of convertible bonds is complex.

Ad Get Complete Accounting Products From QuickBooks. No part of the proceeds received is recorded as equity at the time of their issuance because it is difficult to.

Convertible Bonds Using Market Value Method Accounting Complete Calculations J E S Youtube

Convertible Bonds Using Book Value Method Accounting Complete Calculations J E S Youtube

/ConvertibleBondsPrice2-2285ff1211c545be919565380a232a02.png)

Comments

Post a Comment